When an ecological community’s structure or composition changes over time, we refer to it as “succession.” It is a process we often think about when considering the restoration trajectory.

But change in the structure of Biohabitats? For most of my career, that is not something I spent a lot of time thinking about. I was too busy loving my work and what Biohabitats was becoming to think about it transitioning in any way. When my family and I moved from Baltimore to Charleston, South Carolina in 2010, however, the idea of ownership transition began to creep into my head. I was 50 years old at the time, and I knew that if the company was to continue pursuing its mission to “restore the earth and inspire ecological stewardship” and hold onto its core values long into the future, I needed to think beyond my own lifespan. By 2020, I was ready to begin a more formal process of exploring ownership transition options.

Biohabitats Founder & President, Keith Bowers, 2023

As with any important decision, this one required some reflection on the past.

I founded Biohabitats in 1982 as an S corporation, which means that shareholders own and are legally and fiduciarily responsible for the company. Right from the start, we did things a little differently. I wanted to provide team members with the opportunity to own a stake in the company and share in its profits, so we set up a private stock ownership plan and developed a program where team members could earn and purchase shares of Biohabitats. Because we initiated open book management from the beginning, every team member—even those who were not shareholders—had, and continue to have a strong understanding of, and stake in, the financial health and viability of the organization.

I also wanted team members to participate in the governance of Biohabitats, and in 2008, we implemented our “Leadership Council.” With rotating positions and a component for emerging leaders, this model of governance provides the opportunity for anyone in the company to participate in the highest levels of leadership and operations.

In 2016, we began codifying our culture through what we call Headwaters. It is a living document that lays out who we are, what we do, and most importantly, why we do it. It articulates our mission, five core values, and our DNA tenets of Self Governance, Wholeness, and Evolutionary Purpose. It’s a purposeful attempt to craft a better way to run an organization and structure a business that celebrates all life on this planet. It also made us rethink and realign all our company policies to better align with our mission, values, and DNA. Culture needs to drive policy, not the other way around.

In 2018, Biohabitats filed to become a Benefit Corporation. This overlay to our S corporation designation gave us the legal ability to place social and environmental values on equal footing with fiduciary responsibility. That same year, we became a Certified B Corporation™, signifying that we meet the highest standards of verified social and environmental performance, transparency, and accountability in balancing our profits and purpose.

Threaded through all of these stages in our development as a corporation was the importance of our mission and purpose. In retrospect, all of these initiatives set the stage nicely for a transition to a Perpetual Purpose Trust. But it took some exploration for us to land on that model as a perfect fit.

In exploring ways to transition ownership, three things remained at the forefront of my mind.

First, as a husband and a father, I wanted to make sure that my family would be financially secure as I contemplated my future retirement. It was important to me (and to the other shareholders of Biohabitats) that we would be fairly compensated for the equity we have invested in the company. At the same time, I wanted to ensure that Biohabitats would have the capital it needed after the transition to continue to develop and thrive.

Keith and his daughters, Caroline and Anya. ©Larry Canner

Second, Biohabitats’ culture, values, and DNA of Self Governance, Wholeness, and Evolutionary Purpose are at the heart of who we are. They define us, and I believe they are why we retain such exceptional, passionate team members who are so committed to our craft and mission. This is really important to me, and I wanted to make sure that this framework is carried forward.

Third, at Biohabitats, we have an undercover mission to reinvent capitalism. Maximizing shareholder financial returns is not what drives us. In fact, we believe this short-term driver is one of the leading causes of social and political inequity, climate change, biodiversity loss, and systemic racism. Traditional business models do little or nothing to address these issues head-on. While we are far from perfect, we believe there is a better way to practice capitalism for the good of the Earth and human well-being. We wanted to find a business model that not only allowed us to perpetuate our purpose, mission, and DNA, but one that embraced Nature as one of its primary stakeholders.

Protection of Biohabitats’ unique culture was a factor in the decision to transition to a Perpetual Purpose Trust

As I was researching alternative business models, I stumbled upon the concept of a non-charitable trust as a model that would benefit and protect our purpose rather than a person, or individual shareholders. Not fully understanding how this model compared to other governance frameworks, I encouraged our Leadership Council to establish an Ownership Transition Committee so that team members and internal shareholders could evaluate and co-create a new ownership and governance model to protect our purpose and enshrine our mission in perpetuity. We knew we needed some help, so we retained Alternative Ownership Advisors (AOA); a consultancy born from Organically Grown Company, one of the first companies in the U.S. to become a steward-owned company.

While we are far from perfect, we believe there is a better way to practice capitalism for the good of the Earth and human well-being.

Through a series of workshops with AOA, we explored many ways to transition ownership, including traditional routes, such as transferring ownership internally to existing and new shareholders, and merging with or being acquired by another organization. Transferring ownership internally was ruled out due to the cost of investment required by shareholders. It also failed to address the idea of protecting our purpose for the long term. Although I had been relentlessly approached by private equity investors and firms, allied design firms, and family offices interested in acquiring or merging with us, not one shared our mission, values, and culture, or seemed to have a genuine interest in changing the way capitalism is practiced for the betterment of the world.

We also looked at the possibility of becoming a worker cooperative, like REI, or officially converting to an Employee Stock Ownership Plan. Both these options were more appealing than a merger or acquisition, but both are structured to maximize profit at the expense of the company’s purpose, and both are structured as a commodity saleable to the highest bidder. Neither ensured that Biohabitats would not be sold in the future, and neither would codify or provide long-term protection of our mission and purpose.

We then began seriously exploring the idea of “stewardship” or “trust” ownership. Steward ownership has become a popular model in Europe, and it is beginning to gain momentum in the U.S. Steward ownership companies are committed to two overarching principles:

Self-Governance. Control stays inside the company, with the people directly connected to stewarding its operation and mission. With the control of the company held in a trust, it can no longer be bought or sold.

Profits Serve Purpose. The wealth generated by a steward ownership trust cannot be privatized. Instead, profits serve the mission of the company, and are either reinvested in the company and its stakeholders or donated.

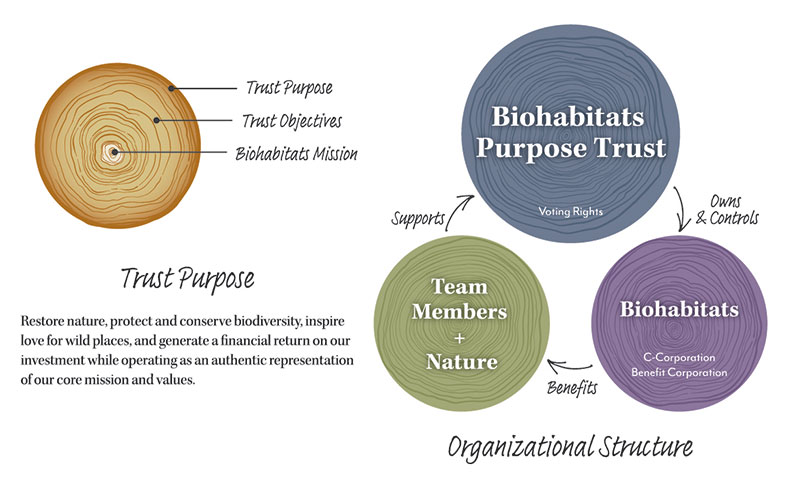

The more we learned about steward ownership, the more certain we were that it was the model for us. We then had to decide which of two types of steward ownership we believed was the best fit: the Perpetual Purpose Trust (PPT) or the Employee Ownership Trust. With the PPT, the trust owns all of the equity of the company, and all profits go to serving the purpose of the company, including sharing with employees and stakeholders. While the company is self-governed, a Trust Stewardship Committee is established to ensure that the company is accountable to its purpose at all times. The employee ownership trust is very similar to the PPT, except it defines who governs the company and benefits from its value more narrowly as just employees.

Because our purpose, mission, values, and DNA make us who we are, we settled on the Perpetual Purpose Trust. It enables us to lock in our purpose, mission, and values without being beholden to any investors not involved in the day-to-day business of Biohabitats.

Best of all, the PPT presents a new vision for businesses practicing in a capitalist market. It shifts the social contract of businesses. Rather than pursuing unrelenting economic growth to satisfy individual shareholders, we get to develop ecological stewardship in a way that benefits all stakeholders. It’s a matter of choosing sustainable, regenerative development over extractive growth.

In the fall of 2022, just as we were coming to this conclusion, Patagonia announced that they were going purpose, and transferring 100% of the company’s voting stock to the Patagonia Purpose Trust to protect their values. While they stole our thunder, they didn’t steal our resolve. In fact, they reinforced the idea that we are on the right path.

All species need oxygen for breathing. But breathing is not their purpose. Just like we need financial returns to stay in business, it is not what drives us. In ecological succession, we see that survival of the fit habitually relies on cooperation and shared purpose as a strategy for evolution. That is what we are doing at Biohabitats. We are putting our shared purpose and values first.