Expert Q&A

By Amy Nelson

Natalie Reitman-White and Elle Griffin are Ownership & Governance Advisors at Alternative Ownership Advisors, a consultancy that helps private companies design and implement ownership, governance and financing solutions that align with mission and protect independence. After serving as Vice President of Organizational Vitality and Trade Advocacy at Organically Grown Company, Natalie transitioned into a new role as a Trustee of the Sustainable Food & Agriculture Perpetual Purpose Trust. After two decades of leadership in the organic trade, she shifted her focus to transformative corporate finance and ownership models that enshrine long-term mission-focus, multi-stakeholder governance and regenerative returns. Elle began her career in accounting and finance, earning a CPA and learning how businesses grow and stall over time. After co-leading a Trust deal in Canada, she noticed how success derived more from the people than the numbers. She then launched a coaching and organizational consultancy practice in 2008. Elle believes that helping people work well together is a key responsibility of positive impact businesses. Natalie and Elle helped guide us through our transition to a Perpetual Purpose Trust, and we were thrilled to have the opportunity to chat with them about the movement toward an economy that puts purpose before profit.

In 2018, the Business Roundtable adopted a Statement on the Purpose of a Corporation, declaring that companies should not only serve shareholders, but also deliver value to customers, invest in employees, deal fairly and ethically with suppliers, and support the communities in which they operate (which includes protecting the environment by embracing sustainable practices). How significant was that statement? Did it generated any interest in alternative ownership structures?

Natalie: It certainly marked a shift, in terms of business leaders recognizing that they have to be accountable to more than just shareholders. So that is positive. What is challenging about the statement is that most of the companies participating in the Business Roundtable aren’t actually looking at making structural changes that would enable them to be accountable and serve their various stakeholders.

The B Corp movement is a step in the right direction, with businesses measuring and being transparent about their footprint and changing practices to improve it, but we also have to look at how companies are owned–who makes the decisions, and where the wealth that a company generates goes. That is the next level of social responsibility.

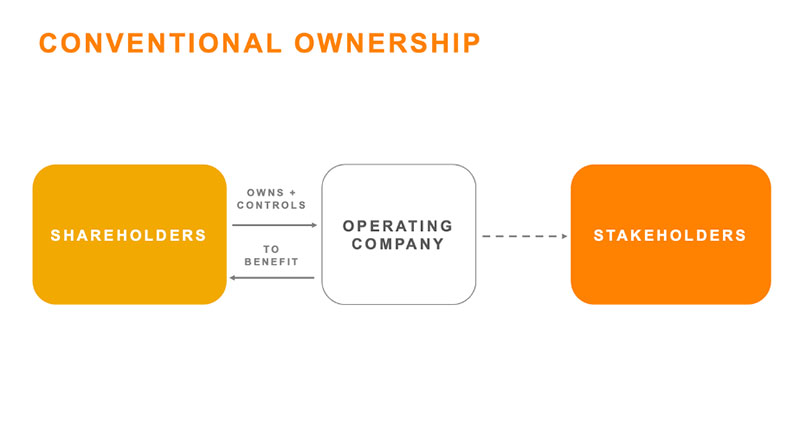

Let’s look at governance. Typically, the people who invest the most money (shareholders) have the most power, elect the board of directors, and so forth. In the models we promote, governance is not based on who is bringing the most money to the table, but rather on stakeholder group representation.

Let’s look at where the wealth goes. Most corporations—even those that work for a purpose—work for shareholders. Shareholders get the wealth from the company, and they can sell it as their private property. In order to shift towards stakeholder capitalism, wealth generated by a company must be shared across stakeholders.

More companies are also opting to do a lot of corporate giving as a portion of their profit, perhaps as members of 1% for the Planet or by creating employee stock ownership plans, but they are usually more elective activities versus sharing that is built into the corporate ownership structure.

Elle: I see the real catalyst being a confluence of three things. First, there is extreme wealth out there looking for a place to go and something to do. Second, business owners have really taken on board the idea and principles of sustainability. Third, we have a generation coming up that is very sharp and looking for a different future. Those three things are coming together and generating a tide that is going to take this to shore.

Natalie: That confluence of factors is leading people to question some of the structures that are driving the results that we have. They are saying, “Maybe we need to change the structures in order to have different results.” It is powerful. When I started as a sustainability manager [at Organically Grown Company] in 2005, people didn’t even know what that meant. Now there is a wave of companies making real commitments to sustainability. Looking at who owns companies and who benefits is the bleeding edge of that wave.

Can you share a bit of your background and how you ended up at AOA?

Elle: I am an ex-CPA who worked on Wall Street doing mergers and acquisitions. After seeing so many deals that looked good on paper fail, while less promising deals succeeded just because people got along with each other, I became interested in how psychology comes to bear when looking at numbers in mergers and acquisitions. I was lucky enough to be asked to co-lead the NAV CANADA transition, where we put the airspace over Canada into a perpetual trust. That was in 1996. That Trust’s revenue stream enabled a technology upgrade to improve safety. I learned from that experience that deals and business can do good things in the world, and if structured properly, they can continue to exist and serve in a completely different way. I decided to get a degree in psychology and focus on corporate governance, and then started my own business to help companies and professional service organizations deal with how they transition ownership as their owners became older and retired. When AOA was announced in 2018, I started following them and thinking I’d love to be involved. When they advertised for a position, I jumped on it.

Natalie: I was a rebellious youth who was given good advice by a mentor to put my rebellious energy towards something positive. So I got involved in environmental and feminist activism. I went on to graduate school to study social movement theory, thinking, “We have all this environmental science telling us that we’re undermining life on the planet, but how do we change human behavior? Social movements take things that are marginal and make them mainstream. How do we do that with corporate behavior?” I realized that if I want to change corporate behavior, I actually had to get inside companies, so I worked on sustainability in the food sector for many years, changing practices, and getting people to see that thinking about environmental sustainability and social responsibility actually made for better business. After starting trade associations for sustainability leadership in the sector, I realized that the way a company is owned makes a big difference in the degree to which they can change their behavior. I saw that when a company would get sold to a larger parent company, their commitments would sometimes shift, and they would reduce investments in their social and environmental programs.

While I was with Organically Grown I proposed that we establish a committee to explore an alternative ownership structure, because we had a lot of people knocking on our door offering to acquire us, and we didn’t want to be acquired. We wanted to stay independent so we could keep investing our dollars towards the environment and people. In that journey, we discovered the Perpetual Purpose Trust as an option, and soon transitioned to that structure.

We started Alternative Ownership Advisors to help other companies in similar positions who want to maintain independence, have people who are working in the company and close to the mission making the decisions, and use profits to serve the mission, reinvest in the company, and support the people who are creating the value. That is why we do what we do at AOA.

… there is a wave of companies making real commitments to sustainability. Looking at who owns companies and who benefits is the bleeding edge of that wave.

What is steward ownership, and what motivates companies to consider it?

Natalie: Historically, ownership has been passed in two ways. The first way was through blood (i.e., inheritance.) You would have a family business and you would pass your business and your wealth fund to family members. The second way ownership was passed was through shareholding. You would own a company and then you would sell it to the next owner.

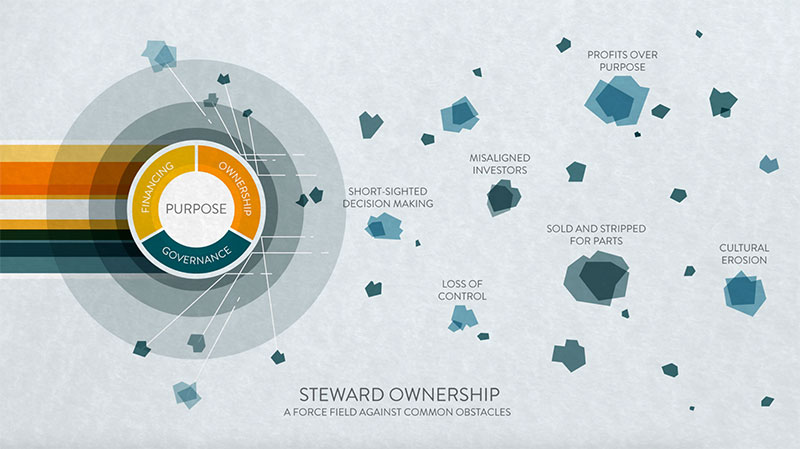

Steward ownership is a third way of passing ownership. In steward ownership models, independence is permanently protected. The company is not a commodity to be bought and sold. It is held by and for its purpose. The company exists to serve its purpose, and a legally binding structure prevents the company from ever being sold. Another aspect of steward ownership is self-governance. People who have demonstrated the ability to steward the purpose hold the voting control and make decisions about where the company is headed. The other component of steward ownership is that profits serve purpose. In steward-owned companies, profits are seen as a means to the end, but not an end in itself. The end is the purpose.

We want to keep the company viable, healthy, and successful so that it can pursue its purpose. That means it needs to stay profitable and have good business planning, but the profits are reinvested back into the business for the most part. They can also be used to share with stakeholders who are contributing value to moving the purpose forward. This could be employees, customers, suppliers, and investors. So investors can bring important things to the table in terms of capital, and they should get rewarded for what they’re bringing, but they are not the reason why the company exists, and the company does not exist to just serve them. They’re one of the stakeholders contributing something and receiving something return, but it is balanced with reinvestment in the business, sharing with the other stakeholders, and keeping the purpose at the center of why the company exists and how it operates.

Are there other types of steward ownership models besides the PPT?

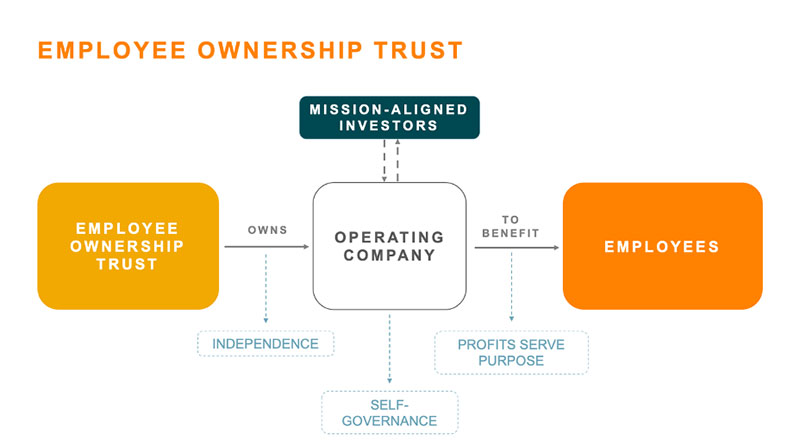

Natalie: Another type of steward ownership is an Employee Ownership Trust, which essentially uses the Perpetual Purpose Trust model but defines who governs the company and who benefits more narrowly as the employees. It is being used as an alternative to ESOPs because it protects the company from ever being sold by the current group of employees to cash in at the future expense of the next employees. It holds the company permanently in trust, so it can never be sold, but the employees are the ones who make the core decision and share the governance and profits.

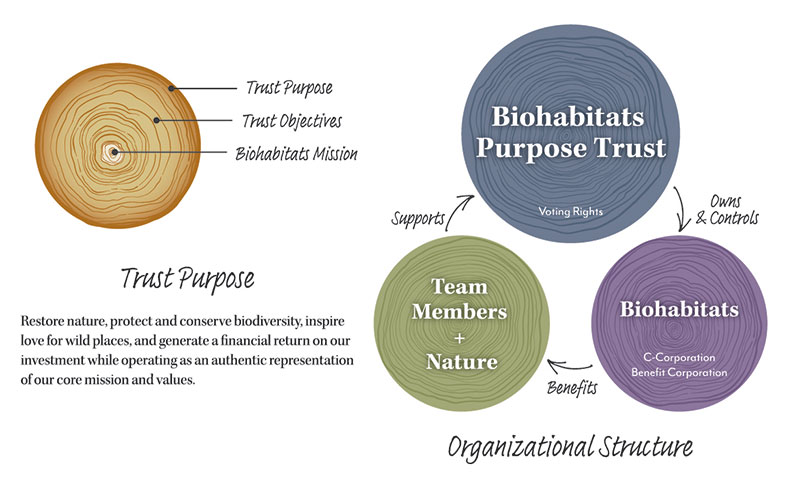

In contrast, the Perpetual Purpose Trust is really about a mission that is more than just benefiting employees. In Biohabitats’ case, it benefits ecosystem protection and restoration, and the company’s ability to continue to provide those services long-term. Employees will share in the governance and in the rewards (as stakeholders), but the Trust doesn’t just exist to serve and benefit them. It exists for the larger mission.

In Biohabitats’ case, a Trust Stewardship Committee known as the “Trust Earth Stewardship Committee” will ensure that the company continues to use profits to serve purpose and abide by all of the terms of the Trust stewardship agreement. Is that right?

Natalie: Correct. Keith Bowers and the other team member-owners of Biohabitats are being replaced by a Purpose Trust—this benevolent owner that never will retire or need to take income from the company because it is not a person. It just exists to hold the company. The Trust Earth Stewardship Committee is the group that governs the Trust and makes sure that the company is accountable to the purpose over time, just like an owner would be. They make sure that the leadership running the company day-to-day is delivering results to the purpose.

Biohabitats’ Trust Earth Stewardship Committee will be comprised of five seats, one of which will be held by nature. Is that unique? Have other companies held seats on similar committees for non-human members?

Natalie: I would say it is cutting edge. We see some companies that have ecological restoration as a prominent feature of their purpose, but in terms of the seats on the trust stewardship committee, typically it’s people with a background associated with the purpose. So it might be workers, former executives in the company, or people from the community or nonprofits affiliated with the purpose. The fact that Biohabitats is specifically reserving a seat for nature, to make sure that there is constant education and accountability to nature’s voice in the room in all the major decisions, is unique. It is also very powerful, because it’s not just written in the purpose statement. You’re actually going to have somebody in every meeting thinking, “What would nature say about this decision?” That demonstrates another layer of commitment and focus.

Elle: It is important to point out, however, that if we look at Indigenous peoples throughout the world, this is not unique. It has been at the core of how they have governed and been caretakers of their communities and surroundings. This has existed long before corporate America ever hit the scene, and we are finally, thank goodness, learning from this. Just like biomimicry, we’re learning from nature and we’re bringing these elements in. That was one of the key things that we heard over and over again in our discussions with Biohabitats. Keith kept coming back to life’s principles and the biomimicry, and how we can learn from nature and infuse that knowledge in how we structure ourselves and respect our surroundings

…if we look at Indigenous peoples throughout the world, this is not unique. It has been at the core of how they have governed and been caretakers of their communities and surroundings.

Natalie: I’ll add that the concept of stewardship ownership—that an organization that you participate in is supposed to generate community wealth and be a good steward of the resources on which it depends— is old. We’re bringing corporations back down to Earth in many ways, by putting the purpose at the center and making corporations accountable to a stewardship role, versus an extractive role for a handful of people.

What is the difference between a company’s purpose and its mission, when talking about a Perpetual Purpose Trust?

Elle: They actually can be the same thing. The purpose can be the mission. One of the things that is different about the purpose, though, is that it is a codified legal statement. It has to be something that the trust steward committee can actually be watching for…something that can be measured.

What is the origin of the Perpetual Purpose Trust model? Was there a country that was ahead of the game in setting up models structured that way?

Natalie: In Europe, there is a history of Trust ownership. Some European companies that have been around for more than 100 years have been Trust owned, where they’re not for sale, their independence is protected, and their governance and profits are shared amongst stakeholders. A prominent example is the John Lewis Partnership, a UK retailer that has been around for some time. Their story is that the grandchildren were about to inherit the stores from their grandparents. They were working side by side with the workers in the stores, and they asked, “Why is this wealth mine? It’s really being created by all these people.” They put their company in a Trust, so that they could never sell it off as their own personal property, and that the wealth it created could be shared with those who were creating it, the workers. It was a very progressive thing to do over 100 years ago.

The legal form of using Perpetual Purpose Trust in the US is fairly new. These trusts have only come on the scene here in the last 30 years. The first use of them was for holding private property, such as an art collection or some money to take care of something that you want protected over time. Utilizing a Purpose Trust for holding the ownership of a corporation is fairly new—within the last five years. Through the National Center for Employee Ownership, we learned that there were companies looking for an alternative to an ESOP where they could put a company in a Trust to benefit the employees, like the John Lewis Partnerships model. Organically Grown was one of the first companies to utilize the Purpose Trust for more multi-stakeholder benefit and a purpose beyond just benefiting employees to include a larger ecological and social mission. Since then, we’ve been working with lots of companies [that are considering Trust ownership structures], and there are many others who are doing so on their own. People are iterating and continuing to build on this model. This is a growing movement.

How many Perpetual Purpose Trusts are there now in the U.S.?

Natalie: It is hard to get an exact count, because there are lots of companies pursuing this model with whom we haven’t worked. Some companies are quiet about their transition, and some are very public. If I were to take a guess, I would say there are probably around 40 U.S. companies that are owned this way. But we are learning every day about companies that have set up these structures that we didn’t know about previously.

Elle: It is also difficult right now, because there only a handful of attorneys currently supporting this. There are probably more than we know, but we know of only six or eight who have actively gotten into it. We are all boldly going where no company has gone before but we’re starting to find each other. We are building a network of people who can create the supporting structures for others to learn about how to develop this for themselves, and how to do the pre-work to get ready to do something like this.

Natalie: We are really building a movement at this point, and it is in the early stages. We are working on four elements. The first is just building awareness about what these models are and the fact that they exist as an alternative ownership structure. Second, we’re creating community, so actually networking together the people who are doing these models to share what they’re doing so they can learn from each other. Third, we’re trying to create infrastructure, so people who are lawyers, CPAs, who can actually help you get the structure done. The fourth component is investors and finance partners who understand these structures and can provide financial resources for owners to get into these structures, or once they’re in the structures to be able to provide capital, which every business does need on these different kinds of terms.

Are you seeing the topic of Trust ownership structures being discussed in business schools and law schools?

Natalie: Not yet, but this is one of our goals. This is like the beginning of the sustainable business movement 20 years ago. When I started in sustainability, there were two business schools offering a sustainable business MBA. Now, almost every MBA program has integrated social and environmental responsibility as the core part of the curriculum. Most major corporations now have chief sustainability officers. Our goal is for this to become an option that is taught and offered as not a fringe thing, but as a mainstream choice. We are in the early days of building the movement. Our prediction is that 20 years from now, this will be the mainstream, because it makes for better companies.

We are doing this because we want to transform capitalism, and I use that word “transform” very intentionally. We want the system to work for people and the planet. We want to take the elements of capitalism that are good—entrepreneurship, using the engine of commerce, people willing to pay for products and services that they want to support—and transform who it serves and who it benefits over time, while making sure that the purpose is at the center. It is a movement, and we are movement builders trying to create the communities and the infrastructure.

Elle: Many people ask, “Is this a trend?” I think the trend is that we’re moving away from conventional ownership, from the stigmatizing brand of aggressive capitalism. What I think is happening is that there is now a really viable option. With the convergence of diversity, equity, inclusion, and belonging, there is a lot of discussion about how to make it all real, and we see the PPT as a real option for doing that. It allows the sharing of profits with the people who created them in the first place. And you can set up a philosophy that really reflects your DEI&B. That really makes me personally feel like we’re contributing to something here. This is a movement, and we are seeing it have great structural underpinnings and strength.

Many people ask, “Is this a trend?” I think the trend is that we’re moving away from… the stigmatizing brand of aggressive capitalism.

What are some other viable, alternative ownership options?

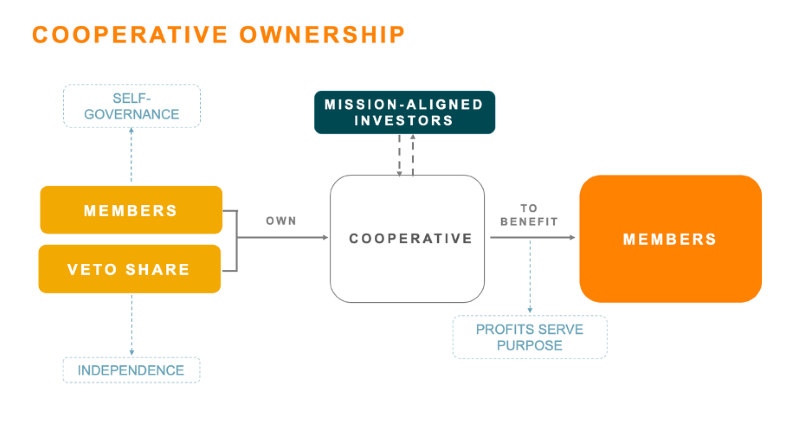

Natalie: A longstanding, historic stewardship ownership model that has been around for a long time is the cooperative, which has a 100+ year history. The notion behind a cooperative is that a business serves a constituency. For example, a farming cooperative, where a group of farmers get together and create a business for mutual benefit. We are now seeing multi-stakeholder cooperatives organized for the benefit of multiple members. That is an old structure of mutual cooperation and benefit.

Elle: Many people ask, “What about an employee stock ownership program?” That is a step in that direction, but we often hear through our clients that a lot of employees are in their twenties and their thirties, and not 50 or 60 years ahead. It doesn’t give them that shared ownership mindset today like with the Perpetual Purpose Trust, where every person in the organization really has to put on the owner hat and be thinking about every single decision. It would be unfair not to mention the ESOP, but it’s just a step. Trust ownerships are going much further towards shared ownership.

As you said earlier, Natalie, with an ESOP, the company could still be bought and sold.

Natalie: That is one of the reasons why some companies are moving away from ESOPs. While employees own the company through stock plans, the Trustee has a fiduciary duty to maximize retirement benefits for employees. If someone comes with an offer that is very lucrative, the Trustee has to potentially sell the company out of employee ownership. It’ll benefit the employees who own the stock today, but future employees won’t get to share in the ownership and the rewards that are created. That’s one pitfall that some mission focused companies are concerned about with ESOPs: they don’t want the ownership to change hands and for the next owner to potentially take the company off the mission.

Elle: We do something called a “fit assessment” with our clients, and you want to see that the company stands for something. With startups, the failure rate in the first year is like 80%, and to put something into perpetuity there really has to be something there, a purpose worth protecting and working on for a very long period of time.

Natalie: The company needs to be viable to be put into a purpose trust. Early stage entrepreneurs interested in this model need to be thinking fundamentally about how to make a viable purpose driven company, and t how it is owned over time.

What would your advice be for a business owner who may be thinking, “I’d like to explore some non-traditional ownership options.” What is step one, and what is a good resource for information?

Elle: My advice to that owner is, look to your leadership. If you get hit by a bus tomorrow, who will come forward? Focus on building a leadership bench that can support the structure moving into a Perpetual Purpose Trust. That is not just leadership, but also ownership and governance. Those are the three hats that an owner wears all the time, but they are not hats an employee is used to wearing. Getting employees ready for that role would be my first advice.

Natalie: I would also advise the owner to start by planning their exit from a financial standpoint. How much do you need to take out of your company for your sweat equity and investment? Over what time period can you actually take that out of the company and let it move towards steward ownership? After you take out your ownership piece, as the company produces moving forward, who do you want to benefit from that? Is it what Patagonia’s done, where 100% of the profits moving forward will go to a climate change nonprofit? Or is it going to be more like the John Lewis Partnership model, where it is all going to go to employees? I would also advise thinking about governance because planning for that often takes time. If you really want to get some value out and make sure the company’s viable, you can’t just drain the bank account. You need to plan it in a way that is sustainable.

Elle: We are hoping that the AOA website, which has so much information, will be moved into the commons and be available open source in perpetuity. There is also a growing group of academics studying this field, so there is a growing pool of resources out there.

Clients will understand that the way Biohabitats has been so intentional in the past, gets to keep going on.

How long does it generally take to transition to a trust ownership?

Elle: It depends on how tricky the financing is, how ready the owner and the leadership bench is, and what your culture is. When it is a perfect fit, like Biohabitats, it can be done in four to six months.

Natalie: The quickest it can happen is probably four months. You have to get your legal team together and structure the deal of transferring ownership from your current owners to a Perpetual Purpose Trust. You have to work out the accounting and the governance structure. You have to articulate your purpose and determine who will steward it.

What do the transition to a Perpetual Purpose Trust might mean for Biohabitats’ clients?

Elle: I love chatting with Keith about Biohabitats’ work. Ecological restoration isn’t a one size fits all thing, and Biohabitats has been so conscious, so intentional in each project it takes on. A hidden benefit of putting Biohabitats into a trust is that they will continue to perpetuate their way of working, which is to be open, to be listeners, to hear all different ways of moving forward for restoration. Clients will understand that the way Biohabitats has been so intentional in the past, gets to keep going on.