Nonprofit Spotlight: Purpose Foundation

By Amy Nelson

In his 1962 book, Capitalism and Freedom, American Economist Milton Friedman wrote, “there is one and only one social responsibility of business—to use its resources and engage in activities designed to increase its profits…” In 1970, when the New York Times published Friedman’s essay, “The Social Responsibility of Business Is To Increase Its Profits,” his theory—which was that businesses best serve society by maximizing profit, returning value to shareholders, and letting the shareholders worry about the greater good—was introduced to the masses. Although the “Friedman Doctrine,” as it became known, did receive some criticism, the message that a company’s primary purpose was maximizing value for shareholders was largely embraced. One could posit that it helped set the stage for the “greed is good” credo of the 1980s. We have seen where that credo has led us.

Fortunately, we are no longer in the 1980s, and there is a movement underway that is disrupting the typical relationship between money and power. More businesses are seeking equitable ownership, governance, and financing structures that enable them to give their purpose, rather than shareholders, primacy. At the forefront of this movement is the nonprofit organization, Purpose Foundation.

With a mission “to build a more just economy by rewriting the rules of who benefits and controls assets in the economy,” Purpose Foundation is advancing change in the legal and financial systems that have upheld business as usual. They pursue this mission through research, education, and programming, and in doing so, they are creating new models that move capital into the long-term service of people and planet.

Purpose Foundation US is the U.S. component of the global Purpose Network, which includes chapters in Germany (Purpose EU), where the organization was founded, and Chile (Purpose LatAm). The expanding Purpose Network includes organizations, entrepreneurs, legal experts, and investors who are working to create and promote better ownership, governance, and finance structures for businesses and communities.

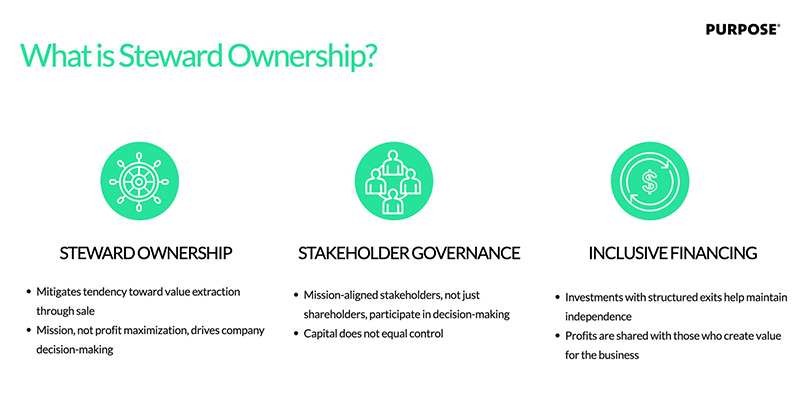

“The campfire around which these organizations sit is the concept of steward ownership,” explained Derek Razo, co-founder of Purpose Foundation and its sister consultancy, Common Trust, “Steward ownership is a way of governing and owning assets that centers on purpose and meaning rather than profitmaking.”

The Purpose Network coined the term “steward-ownership” defining it as a form of ownership that “harnesses the power of entrepreneurial for-profit enterprise while preserving a company’s essential purpose to create products and services that deliver societal value and protecting it from extractive capital.” Steward ownership allows companies to protect and preserve their purpose, independence, and way of doing business. Steward-owned companies legally protect their independence and their profits are reinvested in the business, shared with stakeholders, and/or donated to charity. (See the Purpose Network website for a more detailed definition.) There are several types of steward ownership, including the Perpetual Purpose Trust and Employee Ownership Trust are two forms of steward ownership.

Steward ownership has existed in Europe for more than half a century, but is only recently garnering attention in the U.S. According to Razo, the world is ripe for this kind of innovation in organizational ownership, governance, and financing. “We’re in this phase where no one trusts institutions and everyone feels the need for something new between the rapacious, finance-driven, for-profit monopoly system, and the sort of anemic, nonprofit palliative care,” he said. “The space in between needs to solve the problem of how to build institutions that can provide goods and services in exchange for money, but not become captured and driven off of their purpose by the financial system.”

Purpose Foundation and Common Trust have supported and guided scores of U.S. businesses through the transition to steward ownership and paved the way for countless others to establish more equitable ownership, governance, and financing structures by creating replicable models. They produce and share open source resources, including webinars, reports, articles, and case studies. They conduct research into the best legal and financial tools to facilitate and advance steward ownership. Purpose Foundation publishes a monthly newsletter, and the Purpose Network publishes its own magazine, Stories of Purpose (currently in German but an international version is in the works). The organization’s Purpose Futures Fellows program, now in its third year, supports emerging fund managers who are working on innovative capital vehicles to enable mission and purpose-aligned financing.

While news of Patagonia’s shift to steward ownership made major headlines last fall, Razo points out that several mid-size and smaller companies have made the move with much less fanfare. “There is a local bank in California that’s owned by a Purpose Trust that has been around for 70 years,” said Razo. “Many older steward-owner companies say, ‘We’re not trying to become a giant monopoly. We’re just providing a service for this community.’ Common good is a thematic element that can get lost in the impact driven hype cycle.”

Just as greenwashing impedes the environmental movement, there is, according to Razo, the potential for talk and hype about an equitable, purpose-driven economy to supersede real action toward its creation. But that is not his only concern. While Razo recognizes the contributions of certification programs like B Corp, he is concerned about fragmentation.

“B Corp started before the world became this crazy, fragmented, echo chamber internet hellscape, and they have carved a critical path to meaningful change and that’s great,” said Razo. “But this movement is very fragmented and ironically, not particularly collaborative. There is a lot of opportunity for working together.”

Purpose Foundation is acting on that opportunity, creating cohesion through the partnerships, resources, and annual gatherings associated with the Purpose Network, and the Network’s collective efforts to make steward ownership accessible anywhere in the world.

When it comes to the potential for scaling up and accelerating the movement in the U.S., says Razo, the most impactful change would be the establishment of tax incentives. In the UK, business owners who sell their company to employees through an Employee Ownership Trust are exempt from capital gains taxes, and companies co-owned by an Employee Ownership Trust are able to pay tax-free bonuses (up to £3,600 per employee annually).

Even without tax incentives, a mounting body of evidence suggests that steward ownership is a smart move when it comes to the bottom line. Research conducted by Steen Thomsen, Professor and founding chairman of the Center for Corporate Governance, Copenhagen Business School, shows that steward-owned companies have better employee retention, are more trusted by customers, and are six times more likely to survive after 40 years than traditionally structured companies.

Can businesses become the keystone species in an economic ecosystem that prioritizes purpose and functions to support the greater good? Razo is optimistic.

“As far as I can tell, businesses are competing to be the most powerful actors on the planet. It’s like business versus government versus the planet. We have opportunities to turn all three of those systems towards harmony, and business is going to be play an important role no matter what.”